I recently wrote about how web2 companies interested in crypto — companies I called “web2.5” — have the potential to control the crypto narrative for much of the world, in large part because they have orders of magnitude more users.

The solution to this, of course, is to onboard more people to crypto-native, web3 platforms & applications. The faster more people are onboarded, the less likely it is that web2.5 can control the narrative.

But onboarding isn’t easy. People are often hesitant to use new technology — there can be security concerns, skepticism of a technology’s usefulness, and a steep learning curve.

It’s also difficult to ensure certain values — like a belief in the need for true decentralization — are maintained by new adopters, especially when those values come at the cost of things like high transaction fees. People join for different reasons, from wanting to: make a quick buck, bet on the next big thing, build with friends, decentralize institutional power, or join for the “vibes.”

As a result, I think we are starting to see two primary methods of onboarding emerge in web3:

- Incentivizing people to join/use a product by offering cash rewards

- Attracting participants because of a strong culture

I use the term “product” here and throughout the piece fairly loosely. It can refer to an actual product, a protocol, a community, a company, a DAO, a platform, or whatever else might be a component of web3 that requires onboarding and adoption.

This piece was initially going to be about how cash incentives optimize for speed of user growth while culture-based onboarding optimizes for user retention and the tradeoffs associated with choosing between the two. While writing, I realized that that hypothesis isn’t exactly true.

Let’s start with cash

Financial rewards can accelerate user growth, especially early on in a product’s lifecycle. We’ve seen this time and again — Coinbase offered people a 0.01 bitcoin to sign up in 2013 (today they offer $5), RabbitHole offers people monetary rewards for completing different “quests” that involve early web3 applications, and Lolli gives people free bitcoin daily.

After all, who doesn’t love free money? People tend to be more willing to try something if they’re getting paid to use it. The size of these rewards can determine the speed of adoption — the larger the reward, the more people that will want to join, and the bigger the spike.

In some instances, financial incentives can also create an incredibly loyal user base. The catch, however, is that the timing of financial reward matters.

Receiving a monetary reward in exchange for joining a product or platform rarely incentivizes long-term usage. Instant rewards are akin to how Uber Eats offers $10 off an order to first-time signups or how Panera gives away three months of daily free coffee to new members. I know plenty of people who have signed up for both, milked the free rewards, and then unsubscribed as soon as the trial period ended. (To be fair, this is possibly a function of us having been in college and not working adults, but still). The point is that instant gratification can attract a large new group of members, but it provides little indication about whether those are the type of members platforms and products actually want to attract.

On the other hand, cohorts of people joining with the intent of *maybe *receiving some sort of financial compensation *at some point *are more likely to be long-term users.

The longer someone has to wait for their financial reward, the more loyal and dedicated a user they’ll be. While the get-rich-quick users get flushed out early, those who stay with a product will have seen its evolution and built a relationship with it while waiting for an eventual, potential reward.

Airdrops are a good example of this. Some platforms have (likely) gained adoption from people speculating that there may be an airdrop in the future. The logic is that, by being early users, those people are anticipating potential payouts from those airdrops. But distribution of airdropped tokens is often based not just on who uses a product, but the quality of that usage — did the adopter use it frequently, provide feedback, explore the full suite of features, and so on. As a result, (the expectation of) an airdrop can help a product bootstrap adoption while also aligning incentives — people who demonstrated faith in the product are then rewarded with tokens whose financial value is tied to the value of that product.

The other method I’ve seen gain popularity is culture-based onboarding

Examples of culture-based onboarding include:

- NFT communities (Bored Ape Yacht Club, CryptoPunks, and Chainrunners are some big ones)

- Mirror’s (now sunsetted) “write race”, which gamified writing submissions while cleverly incentivizing community members to participate by voting on their favorite essays

- Axie Infinity’s impressive growth this year from ~600k monthly players in January to ~2.5M players in November

When culture inspires people to start using a product or join a platform, community is often at the root of this adoption.

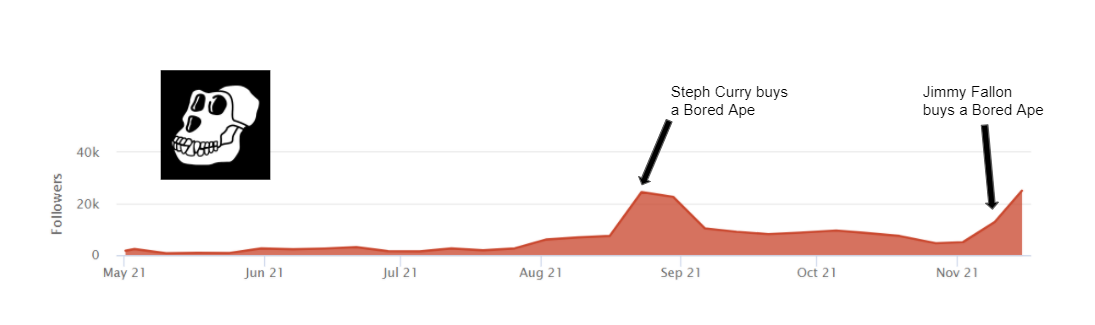

Understandably, it can take time to grow a community, especially in a healthy and sustainable way. But once those communities gain “mainstream” attention, there can be rapid and concentrated spikes in adoption:

Weekly new followers for the Bored Ape Yacht Club Twitter account

One of the interesting things about culture-based onboarding is that buying the product or joining the platform is often gated by finance. It’s the opposite of cash-based onboarding: instead of being paid, you’re paying to join. The more popular a product, item, or community, the more expensive membership may be, especially if people are onboarding to an exclusive community.

I think this is somewhat telling about what drives adoption at a community level. In one respect, communities are about belonging — about finding people who have similar interests and beliefs. But financed-gated communities make me think the more salient driver is access; access to people, to special events, or even just to a certain “tier” of social status.

What does someone really get when they buy a Bored Ape? Access to a Discord, invites to special events (like the Bored Ape Yacht Party during NFT.NYC), and the ability to make their Ape their profile picture and signal to others that they are part of the same club as Steph Curry, Post Malone, Diplo, Steve Aoki, Alexis Ohanian, and even Adidas.

As I mentioned earlier, initially this piece was going to be (in part) about how culture-based onboarding strengthens long-term retention. To an extent, that hypothesis is true; financial skin in the game incentivizes commitment. (Admittedly, liquid markets, like for certain tokens or NFTs, complicate the hypothesis a bit). The endowment effect — where people tend to place a higher value on an item that they own than they would on that same item if they didn’t own it — also plays a role in creating community stickiness.

But there’s also a risk that the culture that attracted so many degrades over time. While going mainstream is often an inflection point for rapid user/participant growth, it can also weaken any checkpoints that help ensure members are there for the right reasons (quality contributions, belonging, shared values, etc.). For a pure product or service, like Coinbase, I don’t think this matters much. That’s also, in part, why cash-based onboarding works better for them. But for products or organizations that rely on community, too many adopters too fast might mean moving away from the core of what was so special in the first place.

So why does this matter?

The goal of any product (community, organization, protocol, etc.) should be to build a strong, committed, enthusiastic, and welcoming base as sustainably as possible. Frequently, the goal is also to do this as fast as possible.

The difficulty with onboarding isn’t so much in the mechanism one uses to onboard (e.g., cash vs. culture), but more so in how incentives are structured at the time of onboarding.

It’s not possible to prescribe one method of onboarding as an end-all solution — context matters, and different communities have different goals. Not all products need the same size user base, nor do all communities need to have the same number of participants. In other words, there’s no Dunbar’s number for crypto.

I also imagine cash and culture aren’t the only two methods for onboarding we’ll see emerge over the next decade. Chris Dixon frequently talks/writes about skeuomorphic and native phases, especially with regard to crypto. Cash and culture — at least in the ways that we’ve seen so far — are fairly skeuomorphic methods of onboarding. My hope is that as new, native methods emerge, they’ll be thoughtful of the trade-offs between speed, sustainability, opportunity, and access.

Thank you to Spencer for reading drafts of this piece.